estate tax changes build back better

House Bill Proposes Changes for Estate Planning Under the Build Back Better Act. The bill would increase the Sec.

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

Any modification to the federal estate tax rate.

. 5376 would revise the estate and gift tax and treatment of trusts. 28 2021 President Joe Biden announced a framework for changes to the US. On November 19 the House passed the Build Back Better bill that includes many tax changes by a vote of 220 to 213.

Heres what you need to know. This new surtax would be imposed on non-corporate taxpayers such as individuals estates and trusts specifically including all undistributed income from estates and trusts in excess of 20000000. The Build Back Better Act includes a 5 surtax imposed on MAGI that have in excess of 10 million as well as an additional 3 surtax if the MAGI exceed 25 million.

The Tax Cuts and Jobs Act the Act increased the federal estate tax exclusion amount for decedents dying in years 2018 to 2025. Gift and Estate Taxes Proposed Under the Build Back Better Act Lowering the gift and estate tax exemptions seems a lock. Tax system to raise revenue for a 175 trillion version of the Build Back Better Plan.

Estate gift and GST tax. The prior version of the Build Back Better bill made substantial and far-reaching changes to the taxation of grantor trusts and transactions between the grantor and the trust which would have virtually eliminated the use of grantor trusts as an estate planning tool. This analysis was updated to contain the November 4th amended changes to the cap on the state and local tax SALT deduction.

The bill would extend the changes to the earned income tax credit that were. An elimination in the step-up in basis at death which had been widely discussed as. The amended change would raise the cap to 80000 from 2021-2030 and revert back to 10000 for 2031.

Proposed Tax and Trust Changes in the Build Back Better Act On September 13 2021 the House Ways and Means Committee proposed sweeping and unprecedented changes to the federal income estate gift and generation-skipping tax laws as part of the Build Back Better Act. Trusts and estates lawyers and advisors have been keeping a close watch on recent developments regarding the tax proposals contained in HR. Senate Yet to Act Friday December 3 2021 Earlier this fall we sent out an.

Tax provisions in the Build Back Better act Extending expanded earned income tax credit. The House Ways and Means Committee recently released a draft of the tax changes proposed as part of the budget reconciliation bill to implement President Bidens social and education spending. Notable aspects of the Biden framework for the Build Back Better Act that will affect estate planning include.

164 b limitation on the deduction for state and local taxes from. Build Back Better Act and What the Changes to Gift and Estate Taxes Could Mean for Your Family Business. Tax Changes for Estates and Trusts in the Build Back Better Act BBBA The Build Back Better Act BBBA.

On October 28 2021 the House Ways and Means Committee issued a revamped proposal in furtherance of President Bidens Build Back Better Agenda. It remains at 40. This means that an individual can leave 1206 million and a married couple can leave 2412 million dollars to their heirs or beneficiaries without paying.

Day Pitney Generations Newsletter. President Bidens proposed Build Back Better Act includes major changes to estate and gift taxes to fund the social and education spending plan. It would eliminate the temporary increase in exemptions enacted in the Tax Cuts and Jobs Act TCJA.

House Bill Proposes Changes for Estate Planning Under the Build Back Better Act. The BBBA proposal seeks to reduce these exemptions from its current 117 million per individual to 5 million indexed for inflation. 28 2021 version that followed the release by.

Under current law the existing 10 million exemption would revert back to the 5 million exemption. The House Ways and Means Committee recently released its plan to pay for President Bidens proposed Build Back Better Act. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for inflation to roughly 62 million as of January 1 2022.

November 5 2021. The exclusion amount is for 2022 is 1206 million. This preliminary analysis is still available here.

115-97 increase the limits on certain discounts of value for. Senate Yet to Act December 3 2021 Earlier this fall we sent out an advisory regarding the estate tax planning implications of the proposed Build Back Better Act the Act which had been introduced in the House of Representatives. 3 2021 the House of Representatives released new draft legislative text updating the Oct.

5376 commonly known as the Build Back Better Act the. The revised version of the bill is silent regarding grantor trusts. While the plan is still in negotiations and changes to the legislation are likely many of the.

Estate and Gift Tax Exemptions The Biden framework does not include lowering the current estate gift and generation skipping transfer GST tax exemptions before the previously scheduled sunset date of December 31 2025. The legislation still faces hurdles in the Senate where its unclear whether moderate Senators Joe Manchin and Kyrsten Sinema will agree to some of the provisions included by the House.

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

Us Treasury Pushes Back As Budget Office Warns Biden S Bill Will Swell Deficit As It Happened Us News The Guardian

Time To Change Your Estate Plan Again

The Big Price Tag To Build Back Better Frank Hawkins Kenan Institute Of Private Enterprise

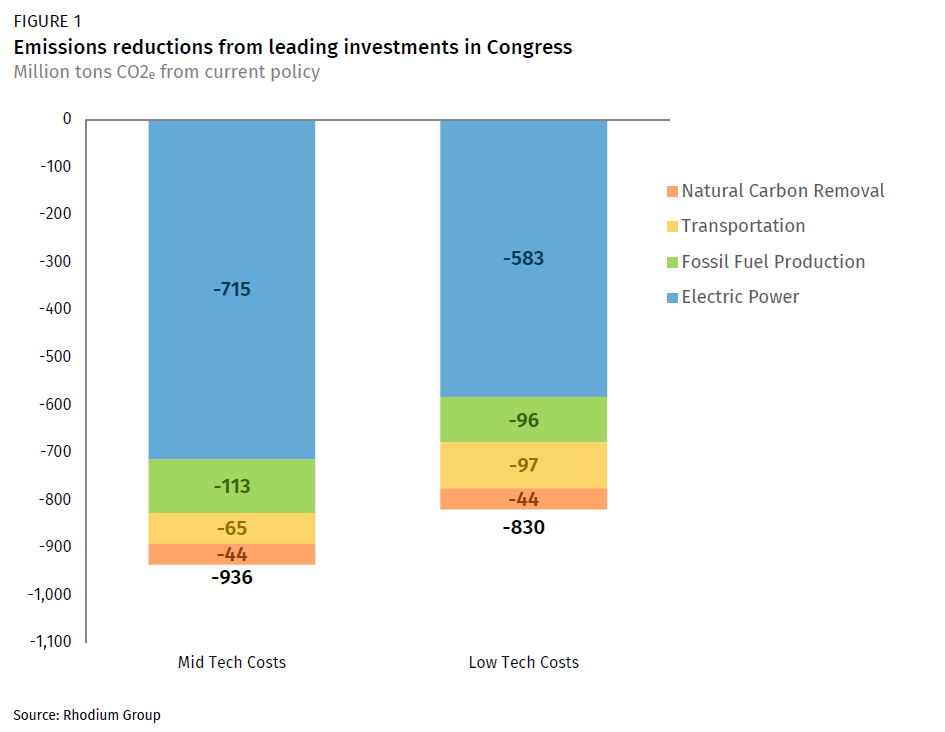

Pathways To Build Back Better Investing In 100 Clean Electricity Rhodium Group

/There-Are-Disadvantages-To-Using-Trust-Funds-57073c733df78c7d9e9f6f05.jpg)

Estate Tax Exemption 2022 Definition

Pathways To Build Back Better Nearly A Gigaton On The Table In Congress Rhodium Group

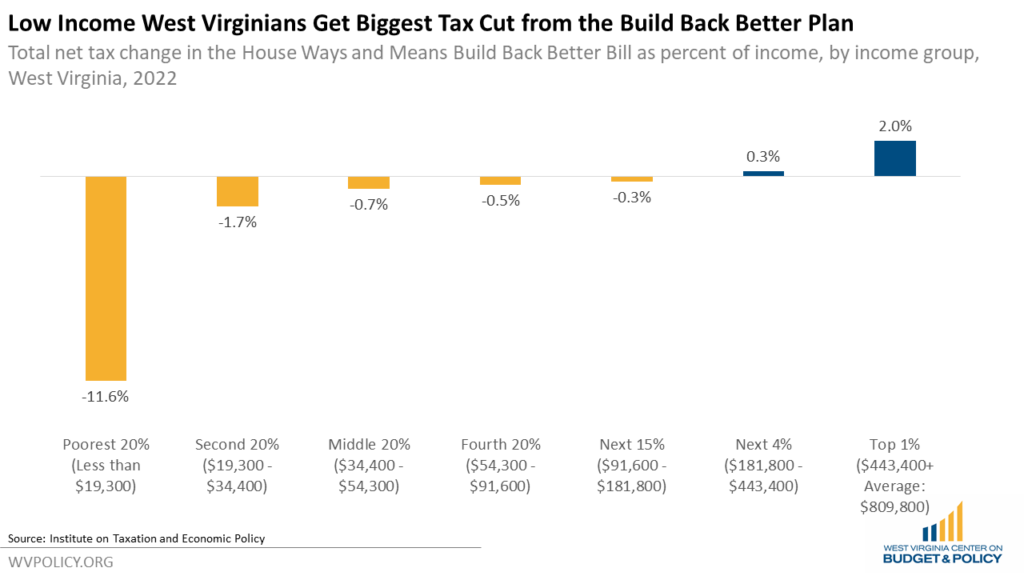

West Virginians And State Economy Will See Outsized Benefits From The Build Back Better Act West Virginia Center On Budget Policy

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

Biden S Bill Funds Niche Items From Electric Bikes To Tree Equity The New York Times

/media/img/posts/2022/02/BBB_figure_5/original.png)

Biden S Biggest Idea On Climate Change Is Remarkably Cheap The Atlantic

What S In The Build Back Better Framework The American Prospect

Outlook On Tax Rates And Policy Changes Our Insights Plante Moran

The Big Price Tag To Build Back Better Frank Hawkins Kenan Institute Of Private Enterprise

Residency To Retirement Healio

Biden S Big Social Spending Bill Probably Will Pass Senate This Month Without Many Cuts To It Analysts Say Marketwatch

Outlook On Tax Rates And Policy Changes Our Insights Plante Moran